Oil & Gas DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

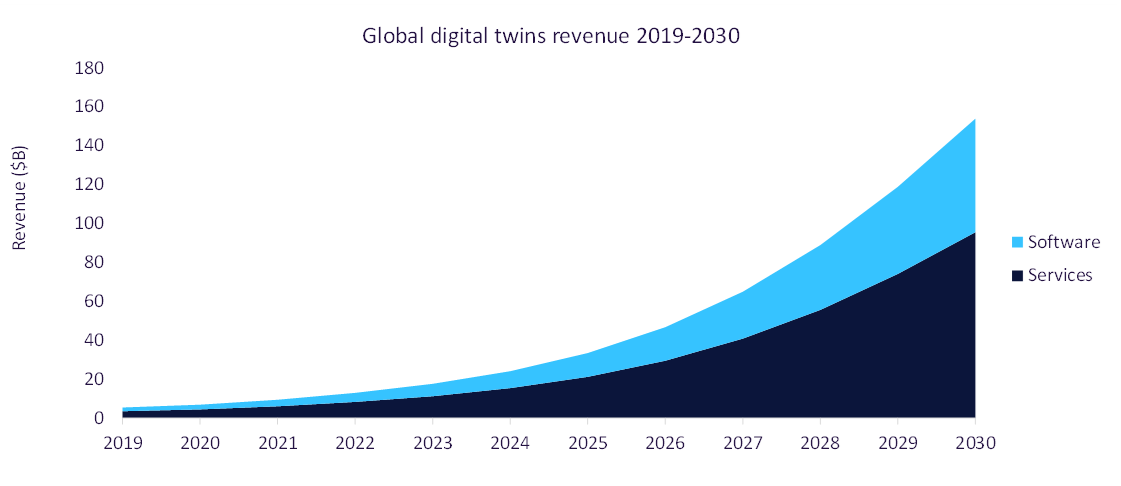

Oil and gas firms turning to digital twins for generating actionable insights

Digital twins can effectively simulate the management of oil and gas assets and forecast potential scenarios.

Digital twins are digital representations of physical assets, systems, people, or processes. These are rapidly becoming a mainstay in oil and gas operations as companies strive to optimise asset performance and minimise unplanned outages. This aims to make oil and gas operations relatively safer while lowering the carbon footprint and improving profitability. Although the major emphasis is on creating digital twins for upstream projects, companies are also deploying these tools within their midstream and downstream assets for remote monitoring and predictive maintenance, among other benefits.

Moreover, they can dynamically model the performance of an operating unit in real time. The process of creating a digital twin begins with the construction of a comprehensive model. It is then coupled with inspection and sensor data coming directly from the asset. As fresh data is incorporated into the twin, the asset operator gains detailed insights into vulnerabilities within the asset. It allows them to implement maintenance and inspection procedures to avert downtime.

By harnessing real-time data, simulation, and analytics, digital twins can offer profound insights about operational assets. It can enable oil and gas companies to streamline processes, preempt breakdowns, bolster safety measures, and thus, enhance overall profitability. With their ability to provide a comprehensive view of operations, digital twins assist in formulating more informed and precise decisions, rendering them indispensable tools in oil and gas operations. This technology was first deployed in capital-intensive oil and gas production facilities to streamline processes, mitigate emission footprint, and generate cost savings. Since then, companies have created twins of their pipeline systems, gas plants, LNG terminals, as well as refineries and petrochemical complexes. The eventual goal is to achieve autonomous operations at production units to boost safety and productivity.

Oil and gas companies are also keen on using this technology for their newer ventures beyond oil and gas, including in carbon capture and storage and renewable power projects. There is considerable potential for digital twins in these emission mitigation or clean energy projects. Besides facilitating remote monitoring, the technology can help companies to improve the efficiency and effectiveness of CCS projects and to predict the power output from wind or solar farms. Another emerging use case for digital twins is in supply chain and inventory management, where products can be tracked in real-time to ensure their timely availability for end-use applications. This would help streamline logistics costs and maintain product quality for end consumers.

Further details of oil and gas companies and their adoption of digital twins can be found in GlobalData’s new theme report, Digital Twins in Oil and Gas.

Latest news

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

BP reports 45% earnings drop in Q1 2024, cites lower energy prices

BP’s first quarter (Q1) results show an underlying replacement cost profit of £2.7bn ($3.39bn), down 45% from $4.9bn during the same period last year.

Sapura Energy secures $1.8bn contracts from Petrobras

The scope of work encompasses operations for the installation of flexible pipes, and electric-hydraulic umbilical and power cables.

US natural gas prices up 3% to 14-week high

Reduced output and increasing demand for liquefied natural gas (LNG) are the drivers of a recent increase in US natural gas prices.

EIA estimates slower world oil demand growth in 2024

The latest report by the US Energy Information Administration (EIA) predicts slower global oil demand growth for 2024 and a 2% decline in US natural gas production from the first quarter (Q1) of 2024 to Q2 2024.

BW Group to separate oil and gas exploration business

BW Group holds 191.9 million shares in BW Energy, equating to 74.38% of the total issued and outstanding shares and voting rights.

OKEA awards EPCI contract to SLB OneSubsea and Subsea7 for Bestla project

The integrated engineering, procurement, construction and installation (EPCI) contract is aimed at expediting the subsea tieback process to extend the life of ageing platforms.

In our previous edition

Oil & Gas Decoded

New report accuses fossil fuel companies of greenwashing, but profits are up

07 May 2024

Oil & Gas Decoded

“Britain has become more unequal” - Greenpeace on green transition tax

06 May 2024

Oil & Gas Decoded

ExxonMobil's $60bn Pioneer acquisition gets nod from US regulator

03 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer