Explorer DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

2024 future product report: Lincoln

A new CEO in the US last year and more recently a fresh leader for China have paused a formerly planned big push into EVs or at least tweaked and delayed the strategy.

With the end of Nautilus production in Canada during 2023, the locally-made Lincoln product line for North America now comprises just three models. As at the end of April, build totals were 11,766 for the Corsair (Louisville Assembly) and 10,832 examples of the Aviator built at Chicago Main, with Kentucky Truck producing 6,675 units of the high-margin, full-sized Navigator.

The Nautilus, which is the brand’s newest vehicle, is fresh for the 2024 model year but unlike the outgoing generation, this one is built solely in China, Changan Ford manufacturing it in Hangzhou (Zhejiang). And whilst this almost five-metre long SUV looks completely different to the previous Nautilus, the platform is the tried and tested FWD-AWD Ford C2 architecture.

Mechanically, there are big changes, the 2.7-litre V6 having been dropped and effectively replaced by a hybrid powertrain. That means a 2.0-litre turbo plus 100 kW motor, combined power being 231 kW (310 horsepower - 25 more than the old V6), drive reaching the road via an e-CVT. Curiously, the Chinese market model has only 207 kW with torque of 407 Nm. And in both markets, buyers may instead choose a 250 hp 2.0-litre turbo.

The new Nautilus should be facelifted in 2026 for the 2027 model year and replaced by an EV in 2030/2031. Build may also return to the Oakville plant in Ontario at the same time. That factory is presently offline awaiting the start of a refit, having produced its final vehicle, a Ford Edge, at the end of April.

The eventual restart of any build at Oakville has been pushed back from an originally stated 2025 to 2027 as Ford reassesses the cadence of many future EV launches in North America. All we know for certain is that the retooling is still set to go ahead later in 2024, preparing the plant for production of at least two, possibly three electric SUVs for the Ford and Lincoln brands commencing in 2027. What happens to the workforce during the long hiatus has not been stated.

The cooling of demand for electrified models in general is also why the Aviator Grand Touring (i.e. the PHEV) was recently axed, fewer than one in seven sales of this model having been the plug-in hybrid. The vehicle itself, meanwhile, has just had a facelift, with that highly likely to be the main development for this generation before a successor lands in 2027. That vehicle has been confirmed as an EV with production based at Oakville rather than Chicago.

Ford Motor is also planning to wind down production of one other current Lincoln, the Corsair, a compact crossover. Launched in 2019 for the 2020 model year, build is due to end at the Louisville factory in Kentucky during 2025. Lincoln should however, return to this segment in 2026 or 2027 with an electric successor.

Finally, many questions remain over the fate of the Navigator, the brand’s largest model and a real money-spinner for Ford Motor Company. The present generation was new in 2018 and at one time had been expected to be replaced in 2024. Now, however, it is believed that production will be extended into the latter half of this decade. Particularly as the model is selling so well and Ford will be wanting to wait a while longer before pushing the go button on a potentially electric replacement. What may instead happen is a re-engineering of the existing vehicle with a heavily revised body and updated powertrains.

Latest news

UK retail sales drop 4% in April 2024 amid poor weather

The decline contrasts with the 5.1% growth seen in April 2023 and falls below the three-month average growth of 0.5%.

Analysis: Could UK self-driving unicorn Wayve overtake its competitors?

UK-based autonomous vehicle (AV) technology startup Wayve announced on Tuesday (7 May) that it had raised $1.05bn in a funding round led by SoftBank Group. The funding will be used to boost the development of its Embodied AI technology, which Wayve has claimed can learn from human behaviour.

Piedmont gets state regulator permit for North Carolina lithium mine

The permit, issued after Piedmont Lithium posted a $1m reclamation bond, allows the company to develop an open-pit mine.

AI-powered insurance solutions provider Simplifai garners funding

Simplifai, a company that specialises in AI automation solutions for the insurance and banking sectors, has completed an investment round with Idékapital as the lead investor.

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

Arbuthnot Latham bolsters international banking team

Private and commercial bank Arbuthnot Latham has named Amit Modha as head of the Middle East and a director in the international banking division.

In data: Trends and trajectories in US defence spending

Insights into the dynamic landscape of US defence spending and technological advancements.

Gordian reveals construction cost trend analysis tool

Gordian, a data-driven solutions provider for all phases of the building life cycle, has unveiled its new offering, Data Insights - Cost Trends.

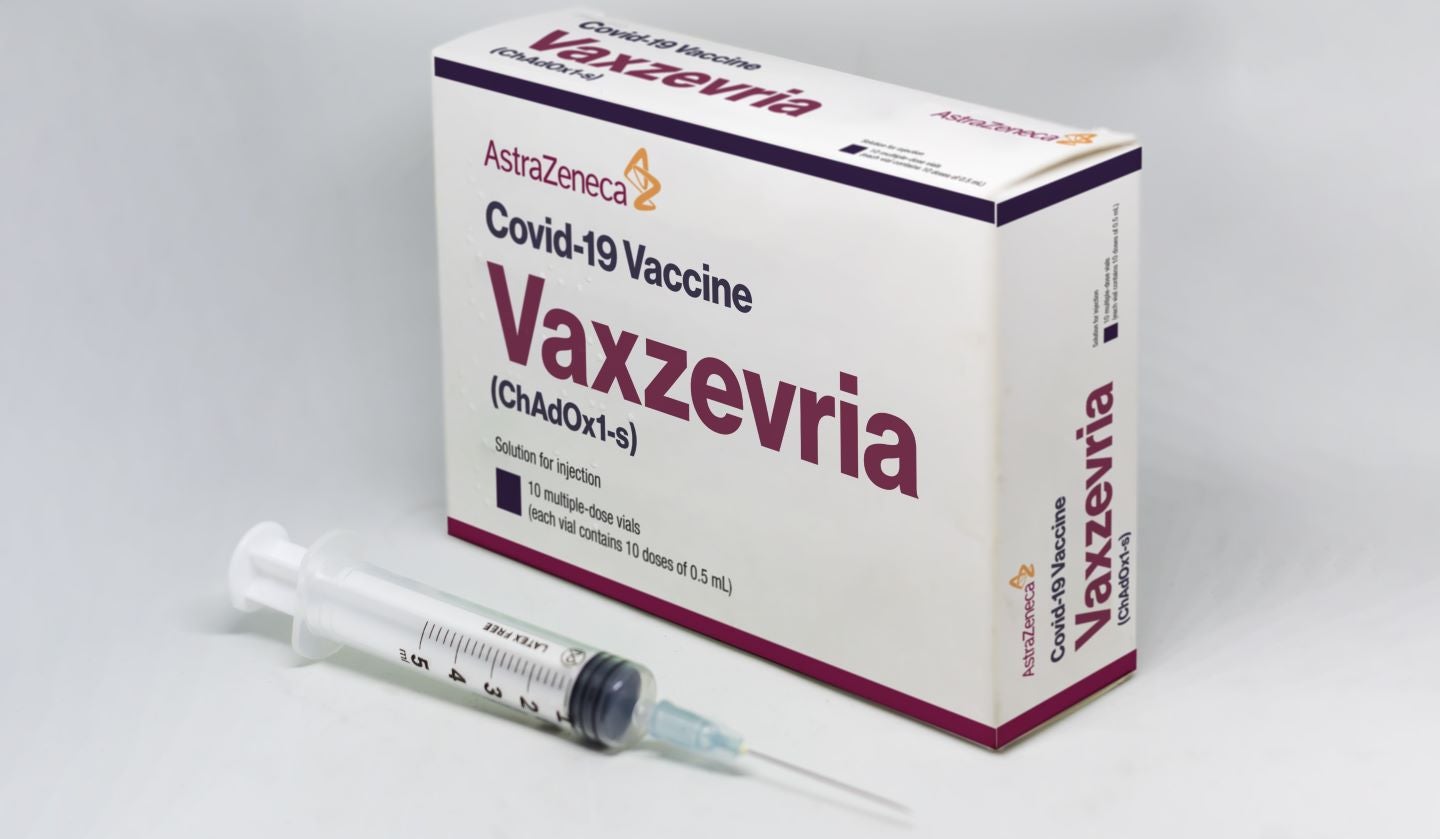

AstraZeneca to withdraw Covid-19 vaccine globally

Countries such as Australia have already ceased the supply of Vaxzevria, with its use discontinued since March 2023.

Campari's “steady” Q1s - key takeaways

Campari’s Q1s represented the first set of quarterly numbers presented by new CEO Matteo Fantacchiotti. He faced questions on the US, Europe and Courvoisier.

In our previous edition

Explorer Decoded

In data: defence M&A deals up 55% in Q1 2024

03 May 2024

Explorer Decoded

Global real-time payments growth ‘sustainable' as new use cases push transactions to record highs: ACI Worldwide

01 May 2024

Explorer Decoded

1 in 3 UK BNPL users struggle as payments spiral

29 Apr 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer