Technology DECODED

Previous edition: 09 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Interview: Fireblocks’ Shahar Madar explains why on-chain hacking is becoming a problem

What is on-chain hacking and what factors play into it becoming more of a concern?

On-chain activity is experiencing a renewed wave of retail institutional and retail capital allocation, which has pushed its total value to over $100bn for the first time since May 2022. We’re seeing this play out on our own platform, with institutional on-chain volume rising by more than 75% in 2024 alone, to almost $4.5bn in monthly volume.

This is exciting for the industry, but it’s not without drawbacks. The influx of capital to on-chain applications has drawn the attention of threat actors looking to take advantage of the obscurity and complexity of on-chain transactions.

Phishing websites, for example, are a leading threat within DeFi, with seemingly legitimate websites prompting inexperienced users to grant attackers access to their wallets, which are subsequently drained. Additionally, smart contracts, which are used for all DeFi transactions, are not human readable, allowing malicious actors to easily trick newer users into harmful trades.

Are there robust enough security standards to address rising levels of institutional investment in digital assets?

The early months of 2024 have already seen attackers exploit a range of vulnerabilities to drain over $500m from DeFi wallets, whilst 2023 saw a total of just over $1bn lost to DeFi hacks. This highlights that not only are hacks becoming more prevalent due to the increase in attention from institutions, but attacks are also becoming more sophisticated. Security standards in the space need to match the increasing threat of bad actors, ensuring that institutions and retail investors can hold digital assets safely.

What kind of technology defence mechanisms are most effective in addressing the problem?

To prevent on-chain hacking, we need to create a way for users to safely navigate the space and minimise interactions with malicious actors. At Fireblocks, we’ve recently introduced a new dApp protection feature that automatically detects suspicious smart contracts, phishing websites, and compromised dApps, alerting users before they interact with a potential threat. By preventing user interaction with threat actors, we’re able to stop harmful transactions from taking place.

The illegibility of smart contracts is another key issue. DeFi players need to introduce technology that can translate complex code into an understandable format. This is something that we’ve also recently introduced at Fireblocks. Our new Transaction Simulation feature translates complex contract call information into a human-readable message, allowing users to validate the contract’s intent and preview the impact on their wallet balance before signing.

On the on-chain protocol and apps side, trust with newcomers can be built by prioritising proactive security measures, intuitive interfaces, and with ongoing education. Mitigating risks is crucial for fostering rapport. Following security best practices like the Rekt Test can help builders focus on the essentials first.

What is the feedback from your institutional customers about how much of the problem on-chain hacking is and how they are addressing it?

The rise of on-chain activity has attracted attention from sophisticated attackers, resulting in over $500m being drained from wallets through various methods like phishing websites and dApp takeovers. This calls for heightened caution.

For institutional investors navigating onchain transactions, the risks are significant. They manage significantly more funds than the average consumer trader, and the risks of unknown and unpredictable onchain engagements is something they have to consider within their risk portfolio, which is essentially what holds them back.

The more heavily-resourced, security-oriented businesses are assigning the responsibility of onchain security assessment to specific individuals and sometimes entire teams. That function within the organisation is essentially an extension of the concept of business analysts who would assess trading opportunities, with the main difference being that these onchain security teams are now examining protocols and dApps. However, this is not something that every organisation is willing to invest in, or is able to set up.

To address this, Fireblocks introduced new threat detection features in our onchain suite: dApp Protection and Transaction Simulation. dApp Protection offers real-time alerts to prevent interactions with suspicious smart contracts and phishing sites, while Transaction Simulation allows users to preview token balance changes before signing, ensuring transparency and security. Simplifying the security context of onchain activity enables easy and secure operations for all businesses.

Finally, what are the potential consequences if companies do not address the problem?

Our suite of DeFi protection tools moved to early access at the end of 2023 and since then customers have been using our transaction simulation feature to easily verify the impact of a contract call before signing. They’ve highlighted that this is a game changer, providing teams with much more clarity into on-chain operations and adding another layer of protection against DeFi threats.

The influx of funds moving into the space means that high security standards are not just a nice-to-have but are absolutely critical and any business looking to be taken seriously needs to show that they can protect customer funds.

Fireblocks new DeFi Security features are aimed to elevate the level of security on our platform for onchain asset management. Organisations that ignore security best practices and do not use proper security tools to protect themselves, especially in times when the number of attacks are increasing, do so at their own peril.

Latest news

Analysis: Could UK self-driving unicorn Wayve overtake its competitors?

UK-based autonomous vehicle (AV) technology startup Wayve announced on Tuesday (7 May) that it had raised $1.05bn in a funding round led by SoftBank Group. The funding will be used to boost the development of its Embodied AI technology, which Wayve has claimed can learn from human behaviour.

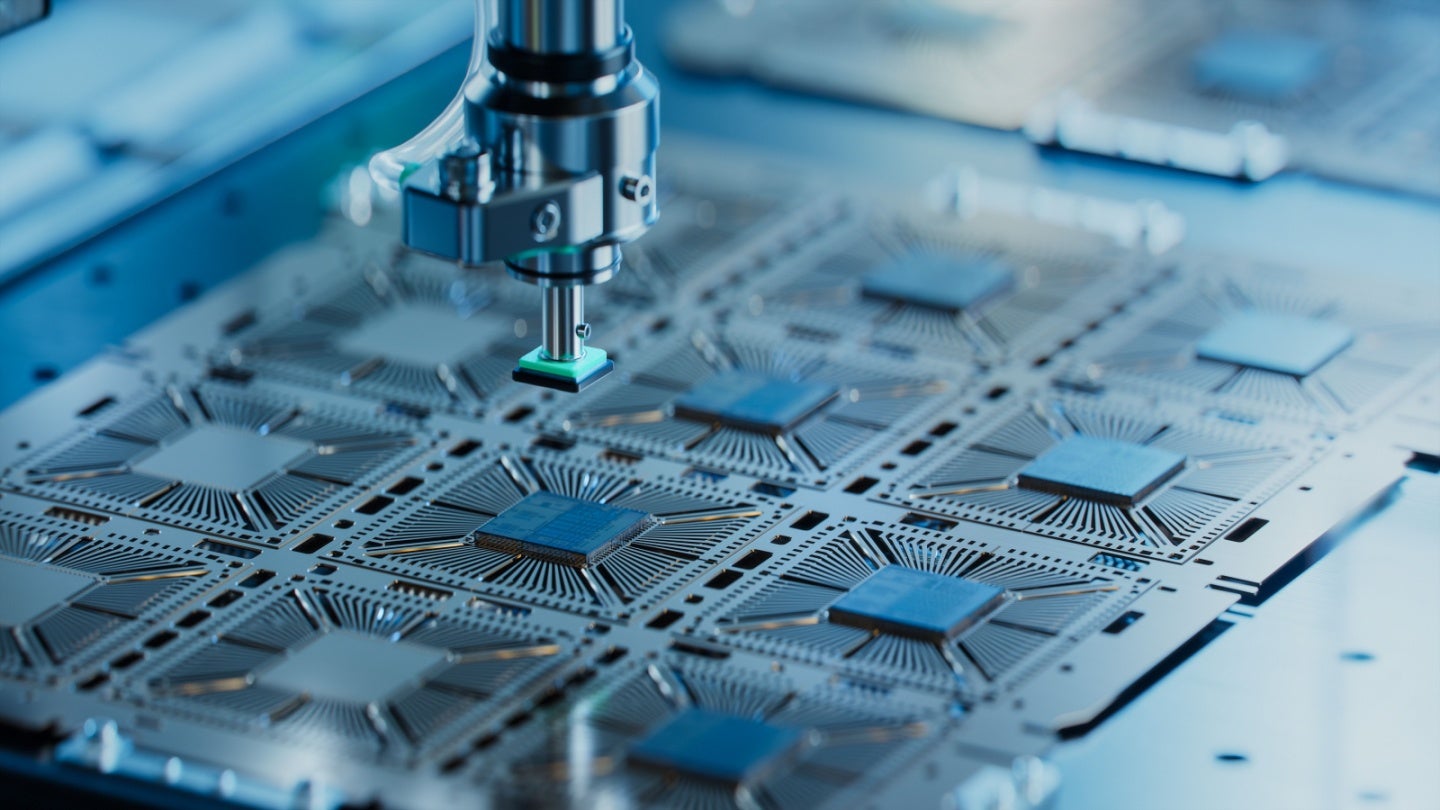

In data: US semiconductor industry attracted over $100bn in foreign direct investment since 2019

The US semiconductor industry has attracted over $100bn in foreign direct investment (FDI) since 2019, making it the largest recipient of FDI globally according to research and analysis company GlobalData.

How did China hack the UK Ministry of Defence?

China stands accused of hacking the UK Ministry of Defence (MoD) in a major cyberattack on armed forces’ SSCL payroll data system.

AWS and CrowdStrike expand cybersecurity partnership

Amazon Web Services (AWS) announced on Friday (3 May) that it has expanded its cybersecurity partnership with CrowdStrike.

Speculation mounts about Ministry of Defence IT supply chain following personal data breach

Personal data of an unknown number of Ministry of Defence (MoD) staff has been accessed in a significant data hack by China, according to reports released on Tuesday (6 May).

Digital Realty and Oracle team up to boost AI growth for enterprises

Digital Reality, a global provider of cloud and carrier-neutral data centre solutions, has announced a partnership with Oracle to accelerate the growth of AI for enterprises.

In our previous edition

Technology Decoded

Speculation mounts about Ministry of Defence IT supply chain following personal data breach

08 May 2024

Technology Decoded

What is no-code AI and why does it matter?

07 May 2024

Technology Decoded

What is no-code AI and why does it matter?

06 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer