Explorer DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

In data: Trends and trajectories in US defence spending

Insights into the dynamic landscape of US defence spending and technological advancements.

GlobalData's latest report illuminates the factors driving the surge in US defence spending, the evolution of priorities, and the projects shaping the future of American military capabilities.

Amidst escalating global tensions, the United States' defence budget has surged to abnormal levels, fueled by geopolitical rivalries and the imperative to maintain technological superiority. GlobalData's "US Defense Market 2023-2028" report unveils drivers and trends shaping the US defence market, offering insights into the dynamic landscape of defence spending.

Catalysts for US defence spending surge

According to the report, the US defence budget soared to $818.8bn in 2023, marking a 10.7% increase from the previous year. This surge comes amidst geopolitical tensions, notably the Russian invasion of Ukraine and escalating disputes with China, prompting a rebound in defence spending. The National Defense Authorization Act (NDAA) for 2024 anticipates a further 2.8% increase, projecting a budget of $841.4bn, with the total defence budget forecast to reach $931.6bn by 2028.

Factors fuelling this surge include ongoing global modernisation of defence technologies, armed conflicts in critical regions, and concerns over China's assertiveness in the Indo-Pacific. The looming spectre of a Chinese invasion of Taiwan heightens US security strategy concerns while countering Russian aggression in Europe and supporting allies like Israel amid conflicts like the Israel-Hamas tension, further driving defence investment.

Key to this is the allocation of funds towards acquisitions, which accounted for 36.1% of the total budget in 2023, amounting to $295.8bn. Major procurement programmes, including submarines, destroyers, and aircraft, contribute to the growth trajectory alongside foreign military aid packages.

Challenges in navigating the US defence market

The report highlights geopolitical drivers behind this expenditure surge, including tensions with Russia and China. The conflict in Ukraine has necessitated increased support for NATO allies and modernisation efforts to counter Russian aggression. Similarly, competition with China in the Indo-Pacific region has prompted strategic realignments and technological investments.

Furthermore, the report underlines challenges in defence production capacity and vulnerabilities in global supply chains. Initiatives such as the CHIPS and Science Act 2022 aim to mitigate these vulnerabilities and foster long-term growth in critical defence industries.

Projects promise to shake up US military capabilities through technological advancements. The B-21 Raider, Arleigh Burke-class guided-missile destroyers, and Gerald R. Ford-class aircraft carriers are examples of reshaping capabilities across the air, land, and sea domains.

How the US 2024 elections could shift defence priorities

However, navigating the US defence market involves more than just technological advancements. Political factionalism, budget battles, and regulatory complexities pose challenges for industry players and investors alike. Deep factional divides within Congress, economic uncertainties, and supply chain vulnerabilities complicate defence procurement and investment decisions.

The upcoming 2024 US elections are poised to influence defence spending, with potential ramifications for global politics and industry investment. While both major parties are unlikely to alter the baseline military budget drastically, the outcome will impact military aid to Ukraine and other allies, with Democrats generally in favour of continued support.

Despite these challenges, the US defence market offers opportunities for collaboration and strategic partnerships.

The GlobalData report paints a picture of the dynamic US defence market, highlighting the interplay between geopolitical tensions, technological advancements, and regulatory frameworks. As global tensions continue to escalate, the trajectory of US defence spending remains pivotal in shaping international security dynamics.

Latest news

UK retail sales drop 4% in April 2024 amid poor weather

The decline contrasts with the 5.1% growth seen in April 2023 and falls below the three-month average growth of 0.5%.

Analysis: Could UK self-driving unicorn Wayve overtake its competitors?

UK-based autonomous vehicle (AV) technology startup Wayve announced on Tuesday (7 May) that it had raised $1.05bn in a funding round led by SoftBank Group. The funding will be used to boost the development of its Embodied AI technology, which Wayve has claimed can learn from human behaviour.

Piedmont gets state regulator permit for North Carolina lithium mine

The permit, issued after Piedmont Lithium posted a $1m reclamation bond, allows the company to develop an open-pit mine.

AI-powered insurance solutions provider Simplifai garners funding

Simplifai, a company that specialises in AI automation solutions for the insurance and banking sectors, has completed an investment round with Idékapital as the lead investor.

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

Arbuthnot Latham bolsters international banking team

Private and commercial bank Arbuthnot Latham has named Amit Modha as head of the Middle East and a director in the international banking division.

Gordian reveals construction cost trend analysis tool

Gordian, a data-driven solutions provider for all phases of the building life cycle, has unveiled its new offering, Data Insights - Cost Trends.

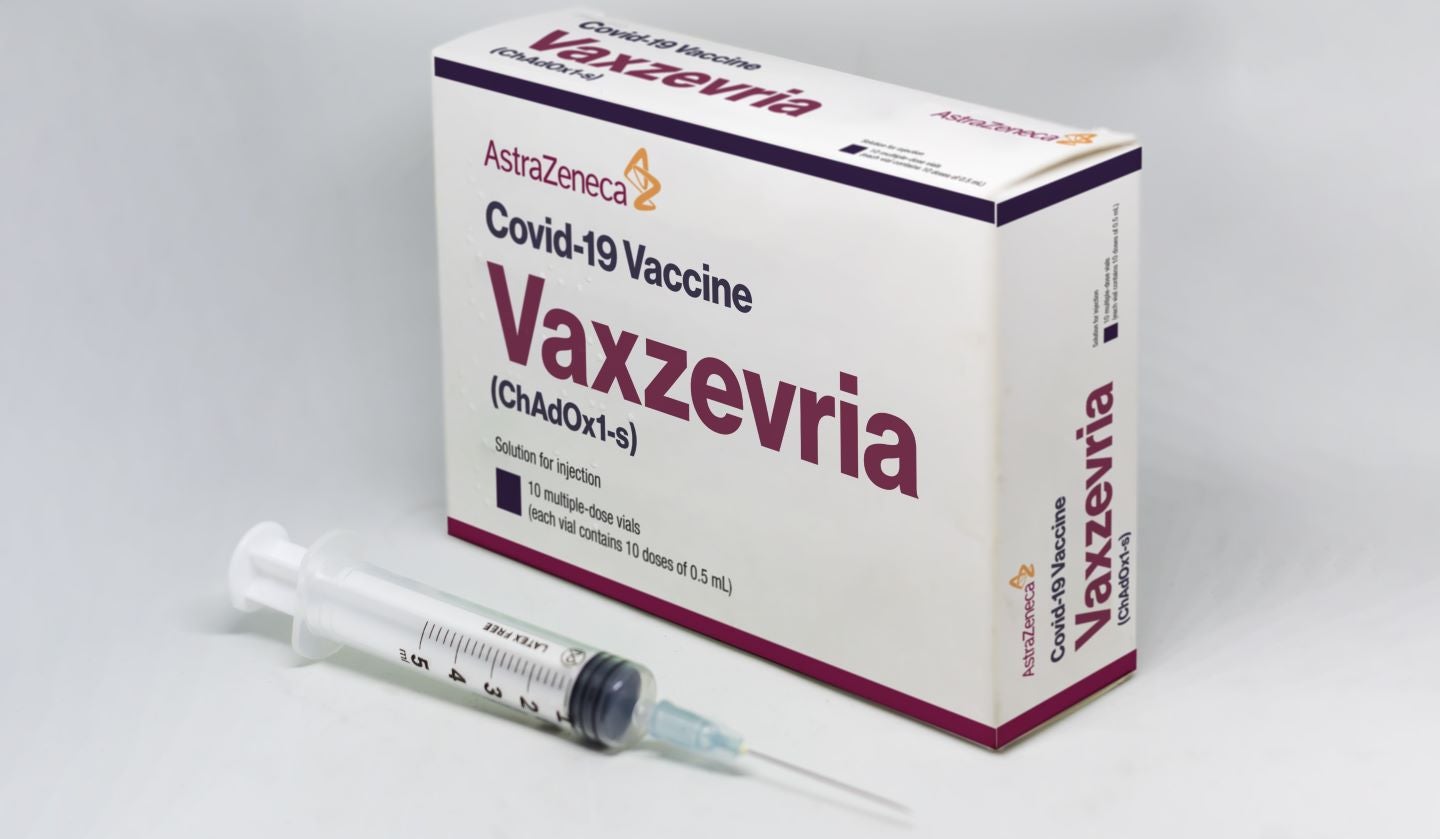

AstraZeneca to withdraw Covid-19 vaccine globally

Countries such as Australia have already ceased the supply of Vaxzevria, with its use discontinued since March 2023.

2024 future product report: Lincoln

A new CEO in the US last year and more recently a fresh leader for China have paused a formerly planned big push into EVs or at least tweaked and delayed the strategy.

Campari's “steady” Q1s - key takeaways

Campari’s Q1s represented the first set of quarterly numbers presented by new CEO Matteo Fantacchiotti. He faced questions on the US, Europe and Courvoisier.

In our previous edition

Explorer Decoded

In data: defence M&A deals up 55% in Q1 2024

03 May 2024

Explorer Decoded

Global real-time payments growth ‘sustainable' as new use cases push transactions to record highs: ACI Worldwide

01 May 2024

Explorer Decoded

1 in 3 UK BNPL users struggle as payments spiral

29 Apr 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer