Mining DECODED

Previous edition: 09 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

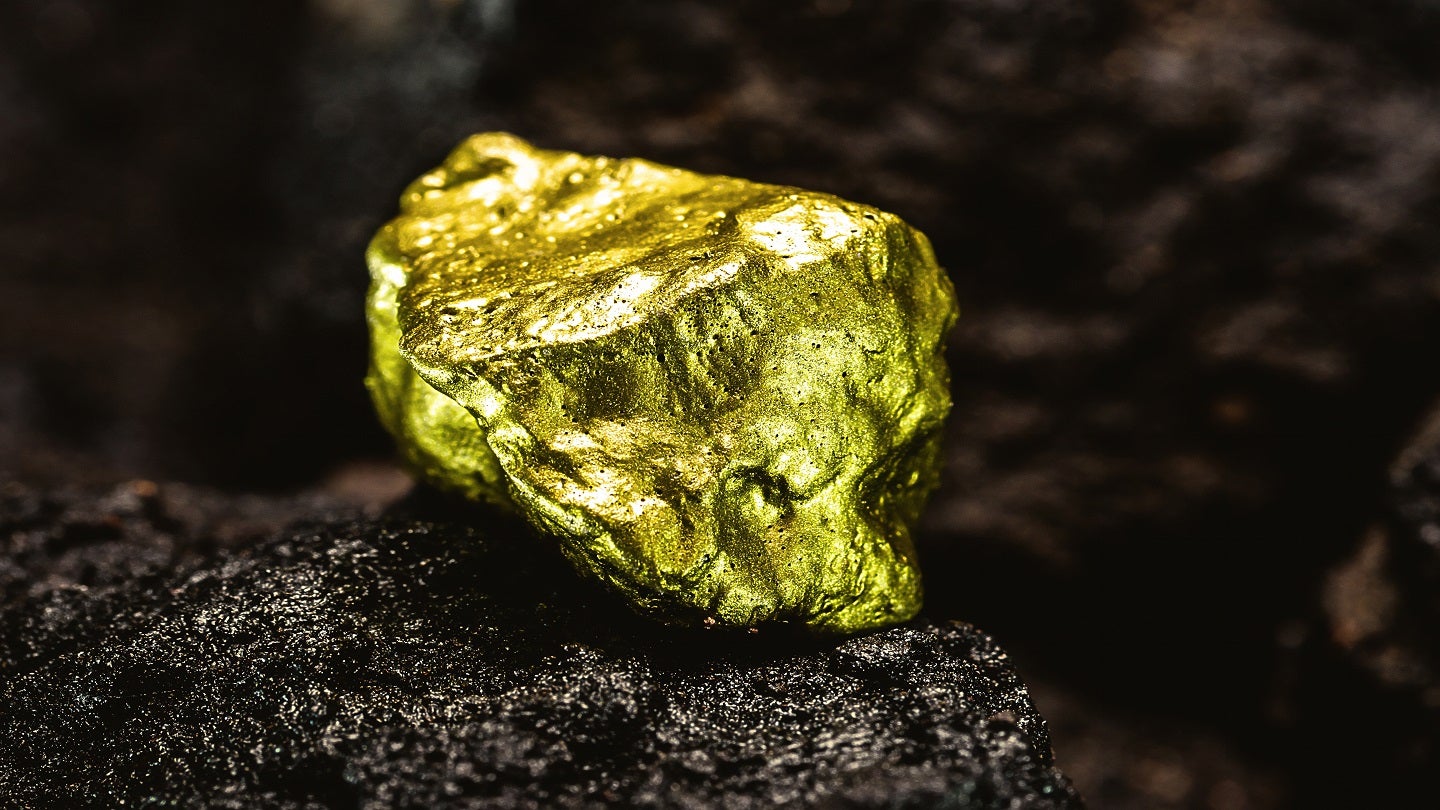

Ganfeng to acquire Leo Lithium's Mali project stake for $342.7m

Ganfeng Lithium Group has reached an agreement to acquire its partner Leo Lithium's remaining 40% stake in the Goulamina lithium mine in Mali for $342.7m.

This acquisition includes a $10.5m non-refundable deposit to be paid within ten days of executing the sale and purchase agreement.

The remaining $161m is payable upon completion of the transaction, following the satisfaction of conditions precedent. An additional $171.2m is due by 30 June 2025 or earlier.

Leo Lithium also entered a memorandum of understanding (MOU) to settle all outstanding issues with the Malian Government for $60m.

It announced the completion of the previously announced 5% sale to fund the settlement.

The latest move comes after the introduction of Mali's new mining code last year, which allows the state to have a larger share of new projects.

Leo Lithium's board believes that divesting the company's remaining stake in Goulamina aligns with shareholder interests.

The decision factors in the increasingly challenging sovereign and security risks in the country, the expected economic impact from the adoption of the 2023 Malian Mining Code and the company’s financial position to fund the remaining working capital requirements.

The transaction equates to A$0.43 per Leo Lithium share.

As of 31 March 2024, Leo Lithium reported a closing cash position of A$69.3m, with the Goulamina joint venture (JV) holding an additional $21.8m.

Despite the ownership changes, the project construction remains on schedule, with first spodumene production expected in Q3 2024.

In exchange for offtake and other rights, Ganfeng will pay a 1.5% gross revenue to Leo Lithium in the coming 20 years.

These rights were relinquished by Leo Lithium after termination of a previously agreed cooperation agreement.

Leo Lithium managing director Simon Hay said: “After a long period of discussions together with our JV partner Ganfeng, we have signed a MOU with the Mali Government, resolving all outstanding issues concerning the Goulamina Lithium Project.

“Despite our best efforts to reach a viable agreement with the Mali Government and considering the increasing risks associated with operating in Mali, the impact of the new 2023 Mining Code and the company’s financial position for future funding, the Board of Leo Lithium has determined that a sale of the company’s remaining interest in Goulamina is in the best interests of Leo Lithium shareholders.

“The Board believes the executed sale and purchase agreement with Ganfeng provides our shareholders with certain value under highly challenging circumstances.”

Latest news

Standard Lithium partners with Equinor on sustainable lithium extraction

Equinor will invest up to $160m (Nkr1.75bn) and will secure a 45% stake in Standard Lithium's projects in south-west Arkansas and east Texas.

Aurubis reports growth in first half core profit

Revenues fell from €8.78bn to €8.25bn, primarily driven by lower copper prices and a significant reduction in shapes sales.

BTU Metals to acquire two Ontario gold exploration projects

BTU Metals has announced the acquisition of a 100% interest in two gold exploration projects in the Wawa gold area of northern Ontario, Canada.

Heliostar Metals announces LOI for $20m debt facility

Heliostar Metals has announced a letter of intent (LOI) to secure a senior secured debt facility totalling $20m (C$27.48m), with a fixed interest rate of 10%.

Trinex signs deal for majority stake in Gibbons Creek uranium project

Australia’s Trinex Minerals, through its Canadian unit Trinex Lithium (Trinex Canada), has entered a definitive agreement with ALX Resources to acquire up to a 75% stake in the Gibbons Creek Uranium Project in Saskatchewan, Canada.

De Grey launches A$600m equity raise to fund Hemi project

The entitlement offer aims to raise A$256.1m ($168.19m), while the institutional placement looks to garner around A$343.9m.

In our previous edition

Mining Decoded

Piedmont gets state regulator permit for North Carolina lithium mine

08 May 2024

Mining Decoded

Bonterra Resources raises $8.54m in private placement

07 May 2024

Mining Decoded

Mining sector to play pivotal role in Saudi Arabia's economic diversification efforts

06 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer