Oil & Gas DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

EIA estimates slower world oil demand growth in 2024

The latest report by the US Energy Information Administration (EIA) predicts slower global oil demand growth for 2024 and a 2% decline in US natural gas production from the first quarter (Q1) of 2024 to Q2 2024.

The US EIA revised its earlier forecast on world oil demand for 2024 on Tuesday, indicating that it is expected to grow at a slower pace. Additionally, the EIA predicts that global oil output will expand faster than previously estimated, leading to a more balanced market.

In its Short-term Energy Outlook (STEO) report, the EIA estimates that OPEC+ producers have largely adhered to the latest voluntary production cuts, which will expire at the end of June 2024.

The production cuts removed approximately 2.2 million barrels per day (mbpd) of supply from the world oil market in Q1 2024 and tightened markets further in Q2 as additional voluntary production cuts from OPEC+ took effect.

The expiration of voluntary output cuts at the end of June may lead some producers in OPEC+, including OPEC and its allies, to limit their production, according to the EIA.

Last week, three sources within OPEC+ said that the group has not yet started formal discussions regarding the extension of cuts, but it may prolong them if demand does not increase, Reuters reported.

Global oil and liquid fuels consumption is expected to increase by 920,000 barrels per day (bpd) in 2024 to reach 102.84mbpd, slightly lower than the 950,000bpd growth anticipated in April’s STEO report by the EIA.

Additionally, total worldwide production of crude oil and liquid fuels is expected to increase by 970,000bpd to 102.76mbpd in 2024, higher than the previous estimate of 850,000bpd.

Geopolitical tensions between Iran and Israel have increased uncertainty in the already volatile Middle East region, which has supported crude oil prices. However, despite these tensions, crude oil price volatility has remained low for most of the year due to significant spare crude oil production capacity.

In April, the average spot price of Brent crude oil was $90 per barrel (bbl), an increase of $5/bbl from March and the fourth consecutive monthly increase due to the falling global oil inventories. However, daily crude oil spot prices have been falling since then, and as of 2 May, the Brent spot price settled at $84/bbl.

The EIA estimates US dry natural gas production will decline by 2% from Q1 2024 to Q2 2024. June's natural gas production will average 102 billion cubic feet per day (bcf/d), down 4% from the monthly record set in December 2023.

"Some producers have announced curtailments in production or reductions in upstream spending on natural gas-directed activities this year," EIA administrator Joe DeCarolis said in March. "But with so much domestic natural gas production tied to growing crude oil production, we expect natural gas production to decrease far more slowly than prices have."

According to the report, dry natural gas production in the US will fall by 1% this year compared with last year, before rising by 2% in 2025 to a record of almost 105bcf/d.

“The increase in production next year is the result of our forecast of rising natural gas prices, which will create an incentive for more drilling in dry natural gas production regions,” the report reads.

The agency has estimated that domestic gas consumption will increase from the current record of 89.10bcf/d in 2023 to 89.31bcf/d in 2024, and 89.64bcf/d in 2025.

If the projections turn out to be correct, it would be the first time demand has declined since the Covid-19 pandemic in 2020 cut fuel demand.

Natural gas emissions are expected to increase by 1% in 2024, primarily due to greater natural gas-fired power production in Q1 2024 and higher consumption in the residential and commercial sectors in Q4 2024. Meanwhile, petroleum emissions are projected to remain relatively stable throughout the year.

Latest news

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

BP reports 45% earnings drop in Q1 2024, cites lower energy prices

BP’s first quarter (Q1) results show an underlying replacement cost profit of £2.7bn ($3.39bn), down 45% from $4.9bn during the same period last year.

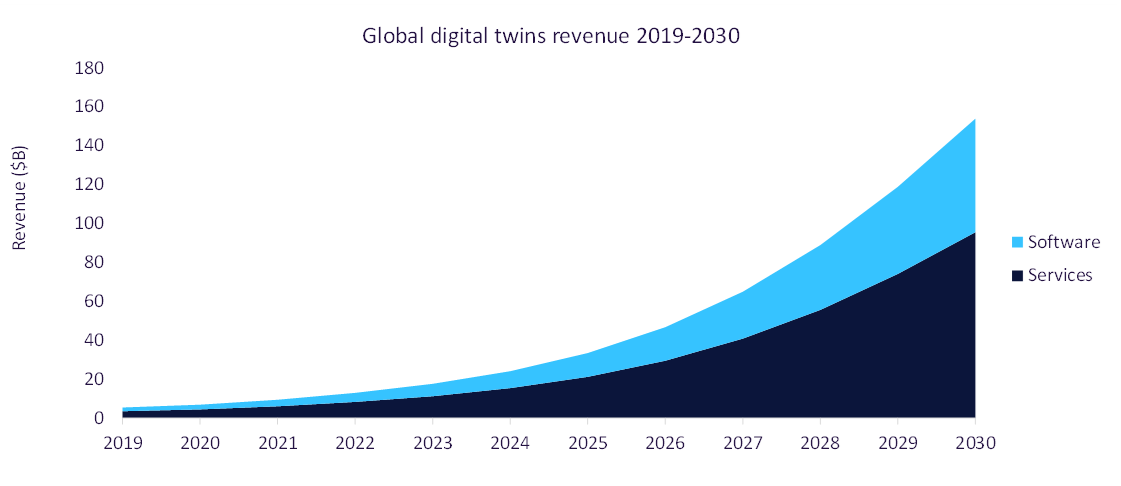

Oil and gas firms turning to digital twins for generating actionable insights

Digital twins can effectively simulate the management of oil and gas assets and forecast potential scenarios.

Sapura Energy secures $1.8bn contracts from Petrobras

The scope of work encompasses operations for the installation of flexible pipes, and electric-hydraulic umbilical and power cables.

US natural gas prices up 3% to 14-week high

Reduced output and increasing demand for liquefied natural gas (LNG) are the drivers of a recent increase in US natural gas prices.

BW Group to separate oil and gas exploration business

BW Group holds 191.9 million shares in BW Energy, equating to 74.38% of the total issued and outstanding shares and voting rights.

OKEA awards EPCI contract to SLB OneSubsea and Subsea7 for Bestla project

The integrated engineering, procurement, construction and installation (EPCI) contract is aimed at expediting the subsea tieback process to extend the life of ageing platforms.

In our previous edition

Oil & Gas Decoded

New report accuses fossil fuel companies of greenwashing, but profits are up

07 May 2024

Oil & Gas Decoded

“Britain has become more unequal” - Greenpeace on green transition tax

06 May 2024

Oil & Gas Decoded

ExxonMobil's $60bn Pioneer acquisition gets nod from US regulator

03 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer