Mining DECODED

Previous edition: 09 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

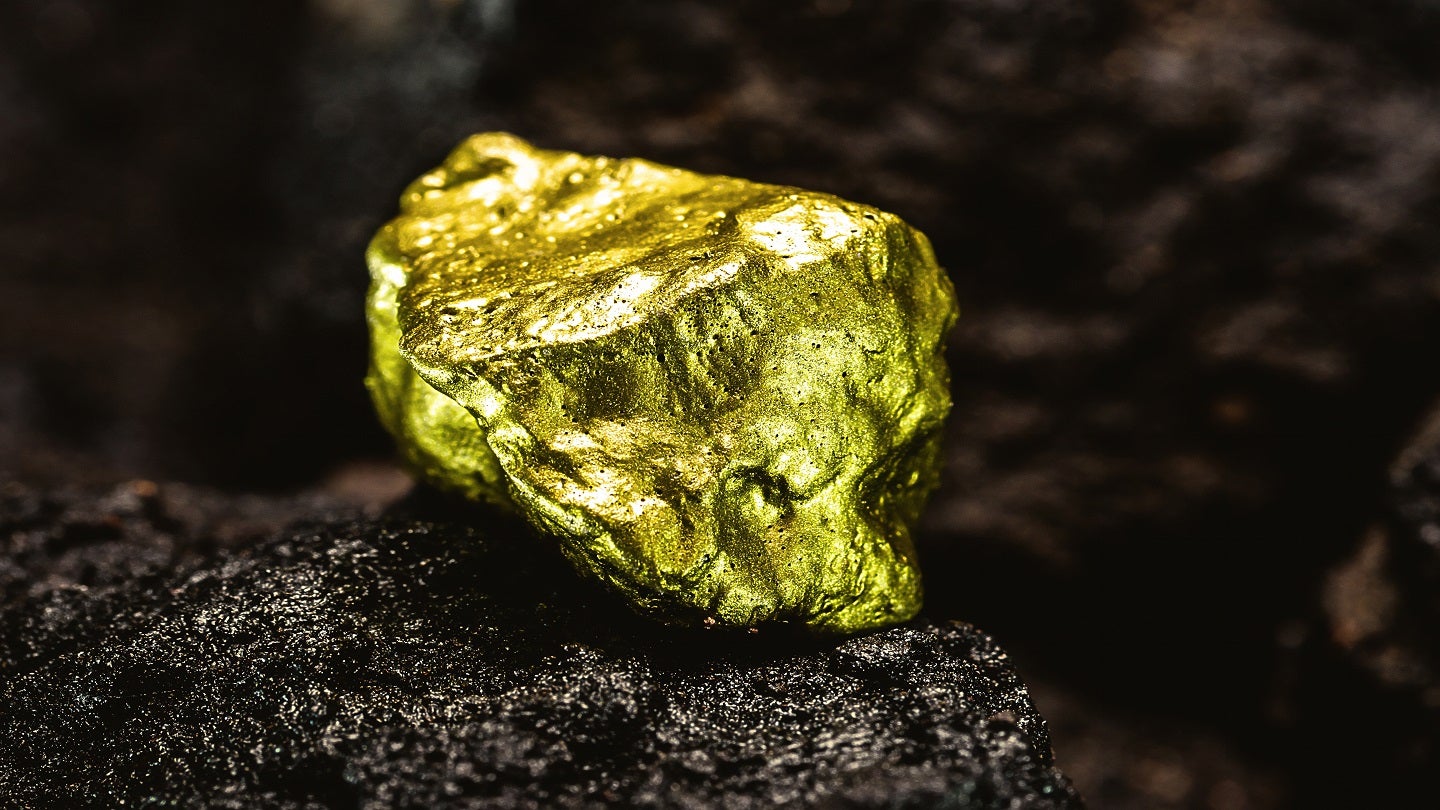

De Grey launches A$600m equity raise to fund Hemi project

The entitlement offer aims to raise A$256.1m ($168.19m), while the institutional placement looks to garner around A$343.9m.

Australian company De Grey Mining has initiated an equity raise, aiming to secure around A$600m through a combination of a non-renounceable entitlement offer and an institutional placement.

The raise will include a 1 for 7.95 pro rate entitlement offer to raise A$256.1m, including a A$174.2m institutional component and a A$82m retail component, along with an institutional placement to garner around A$343.9m.

The funds raised will support the company's Hemi gold project in Western Australia.

This move will include the issuance of 545,482,954 new ordinary shares, which will constitute around 29% of the current shares in circulation.

The placement, which is fully underwritten, will be executed in a single tranche and not require shareholder approval.

The placement will result in the issuance of 312,619,366 new shares, while 232,863,588 new shares will be issued under the entitlement offer.

The equity raising is priced at A$1.10 per share, marking a 13% discount to the last closing price.

Funds from this equity raising, supplemented by existing cash reserves, are expected to completely finance the equity portion of the Hemi project.

These funds are earmarked for the procurement of long-lead equipment, facility manufacturing and fabrication, detailed engineering studies and the finalisation of major contracts.

Additionally, the capital will be allocated towards initial infrastructure and construction costs, commissioning working capital, corporate expenses, general working capital and the costs associated with the offer itself.

The company has stated that this underwritten equity raise mitigates the financial risk associated with the Hemi gold project.

It also facilitates the proactive finalisation of the equity component of the project's financing, which is crucial for the planning and management of the upcoming capital works, including the procurement of long-lead items and contractor appointments.

Additionally, the equity raise is expected to meet a significant precondition for securing debt financing, with the receipt of credit-approved term sheets from debt financiers anticipated by mid-2024.

The company's project execution workstreams, including the ordering of long-lead items and key contractor appointments, are progressing with no significant changes to the capital cost assumptions outlined in the definitive feasibility study.

Construction activities at the Hemi project are due to begin in the later half of 2024, with De Grey targeting the commencement of gold production in the second half of 2026.

Alongside the Hemi project, De Grey will continue its exploration and growth efforts including greenfield exploration and studies on potential underground production at Hemi and regional deposits.

Latest news

Standard Lithium partners with Equinor on sustainable lithium extraction

Equinor will invest up to $160m (Nkr1.75bn) and will secure a 45% stake in Standard Lithium's projects in south-west Arkansas and east Texas.

Aurubis reports growth in first half core profit

Revenues fell from €8.78bn to €8.25bn, primarily driven by lower copper prices and a significant reduction in shapes sales.

BTU Metals to acquire two Ontario gold exploration projects

BTU Metals has announced the acquisition of a 100% interest in two gold exploration projects in the Wawa gold area of northern Ontario, Canada.

Heliostar Metals announces LOI for $20m debt facility

Heliostar Metals has announced a letter of intent (LOI) to secure a senior secured debt facility totalling $20m (C$27.48m), with a fixed interest rate of 10%.

Trinex signs deal for majority stake in Gibbons Creek uranium project

Australia’s Trinex Minerals, through its Canadian unit Trinex Lithium (Trinex Canada), has entered a definitive agreement with ALX Resources to acquire up to a 75% stake in the Gibbons Creek Uranium Project in Saskatchewan, Canada.

Ganfeng to acquire Leo Lithium's Mali project stake for $342.7m

Ganfeng Lithium Group has reached an agreement to acquire its partner Leo Lithium's remaining 40% stake in the Goulamina lithium mine in Mali for $342.7m.

In our previous edition

Mining Decoded

Piedmont gets state regulator permit for North Carolina lithium mine

08 May 2024

Mining Decoded

Bonterra Resources raises $8.54m in private placement

07 May 2024

Mining Decoded

Mining sector to play pivotal role in Saudi Arabia's economic diversification efforts

06 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer