Oil & Gas DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

BW Group to separate oil and gas exploration business

BW Group holds 191.9 million shares in BW Energy, equating to 74.38% of the total issued and outstanding shares and voting rights.

Global maritime company BW Group has announced a corporate restructuring that will see its oil and gas exploration business, BW Energy, become a stand-alone entity.

Based in Oslo, BW Energy has been listed on the Oslo Stock Exchange since February 2020.

Despite the restructuring, there will be no change in the ultimate control of BW Energy.

The shares currently held by BW Group, under the control of BW Group and BW Energy Holdings chairman Andreas Sohmen-Pao through a trust, will be transferred to BW Energy Holdings, which is also owned and controlled by Sohmen-Pao.

The transaction is expected to be finalised by 31 July 2024, with the sales price reflecting the carrying value of the BW Energy shares on BW Group’s books at the time of the transfer.

Sohmen-Pao said: “Following the completion of the mandatory offer from BW Group and subsequent share acquisition of BW Energy shares from BW Offshore Limited, this restructuring is a technical step with no impact on the business or strategy of BW Energy.”

Since its inception in 2016, BW Energy has expanded its oil and gas portfolio to include assets in West Africa and Brazil.

The company's operations include stakes in several offshore fields, such as 73.5% of the Dussafu Marine licence in Gabon, full ownership of the Golfinho and Camarupim fields, a 76.5% interest in the BM-ES-23 block, a 95% interest in the Maromba field in Brazil, and the same percentage in the Kudu field in Namibia.

At the beginning of 2024, BW Energy’s total net 2P+2C reserves and resources were 580 million barrels of oil equivalent.

In March 2024, the company commenced production at the Hibiscus South field within the Dussafu Licence offshore Gabon.

Latest news

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

BP reports 45% earnings drop in Q1 2024, cites lower energy prices

BP’s first quarter (Q1) results show an underlying replacement cost profit of £2.7bn ($3.39bn), down 45% from $4.9bn during the same period last year.

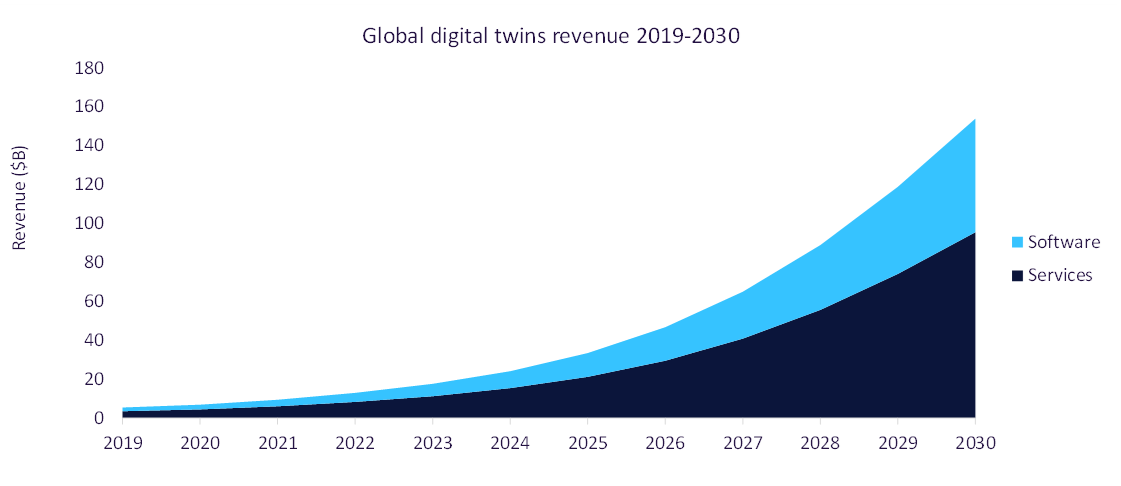

Oil and gas firms turning to digital twins for generating actionable insights

Digital twins can effectively simulate the management of oil and gas assets and forecast potential scenarios.

Sapura Energy secures $1.8bn contracts from Petrobras

The scope of work encompasses operations for the installation of flexible pipes, and electric-hydraulic umbilical and power cables.

US natural gas prices up 3% to 14-week high

Reduced output and increasing demand for liquefied natural gas (LNG) are the drivers of a recent increase in US natural gas prices.

EIA estimates slower world oil demand growth in 2024

The latest report by the US Energy Information Administration (EIA) predicts slower global oil demand growth for 2024 and a 2% decline in US natural gas production from the first quarter (Q1) of 2024 to Q2 2024.

OKEA awards EPCI contract to SLB OneSubsea and Subsea7 for Bestla project

The integrated engineering, procurement, construction and installation (EPCI) contract is aimed at expediting the subsea tieback process to extend the life of ageing platforms.

In our previous edition

Oil & Gas Decoded

New report accuses fossil fuel companies of greenwashing, but profits are up

07 May 2024

Oil & Gas Decoded

“Britain has become more unequal” - Greenpeace on green transition tax

06 May 2024

Oil & Gas Decoded

ExxonMobil's $60bn Pioneer acquisition gets nod from US regulator

03 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer