EU Taxonomy and Precarious Nuclear Energy Classification

-

EU taxonomy draft showing nuclear power under transitional activity has divided countries into pro-nuclear and anti-nuclear stands

-

Countries such as France and the Czech Republic have considerable nuclear power exposure, while Russia and Belarus are expected to start new nuclear power reactors

-

Although European power consumption shows gradual growth over the years, nuclear power “phase-out” seems a distant dream owing to the upcoming investments

EU Taxonomy and Precarious Nuclear Energy Classification

Months of debate and political lobbying came to fruition on New Year’s Eve when the European Commission’s most anticipated sustainability regulation and sustainable finance taxonomy rules were presented. But soon, a massive backlash followed when the EC recognized nuclear and fossil gas power plants under transitional activities as they can “contribute to decarbonization.”

Transitional Activities a Fundamental Discrepancy

Transitional activities are the actions that countries must take to achieve long-term sustainability targets. These activities are not necessarily 100% green but can be over a short period until better alternatives are implemented. According to the taxonomy proposed by the EU, nuclear power activities, such as constructing new nuclear power plants with the best available technologies, demonstration units for advanced nuclear technologies, and electricity generation from existing nuclear installations are classified under transitional activities. In the case of fossil gas, the proposed taxonomy recognizes electricity generation, high-efficiency cogeneration, and district heating operations also under transitional activities. However, these transitional activities will be phased out of the taxonomy as more sustainable alternatives such as renewables become available.

Germany, Austria, and Luxembourg are some of the critics of this classification. Germany has already phased out three nuclear power plants on December 31, 2021, and has plans to phase out the remaining plants by the end of 2022. Austria has threatened to take the EC to court if it goes ahead with the plans. Luxembourg is considering showing its disapproval in the EU council and through legal action.

However, France, the Czech Republic, and Hungary support the new classification of nuclear power. France has enormous exposure to nuclear power and has faced challenges related to regulatory approvals and aging nuclear power plants. The Czech Republic recently unveiled plans to phase out coal by 2033 by increasing its reliance on nuclear sources. Hungary is constructing a large Russian-type nuclear plant to satiate industrial-scale electricity demands without greenhouse gas emissions.

Future of European Nuclear Energy Landscape

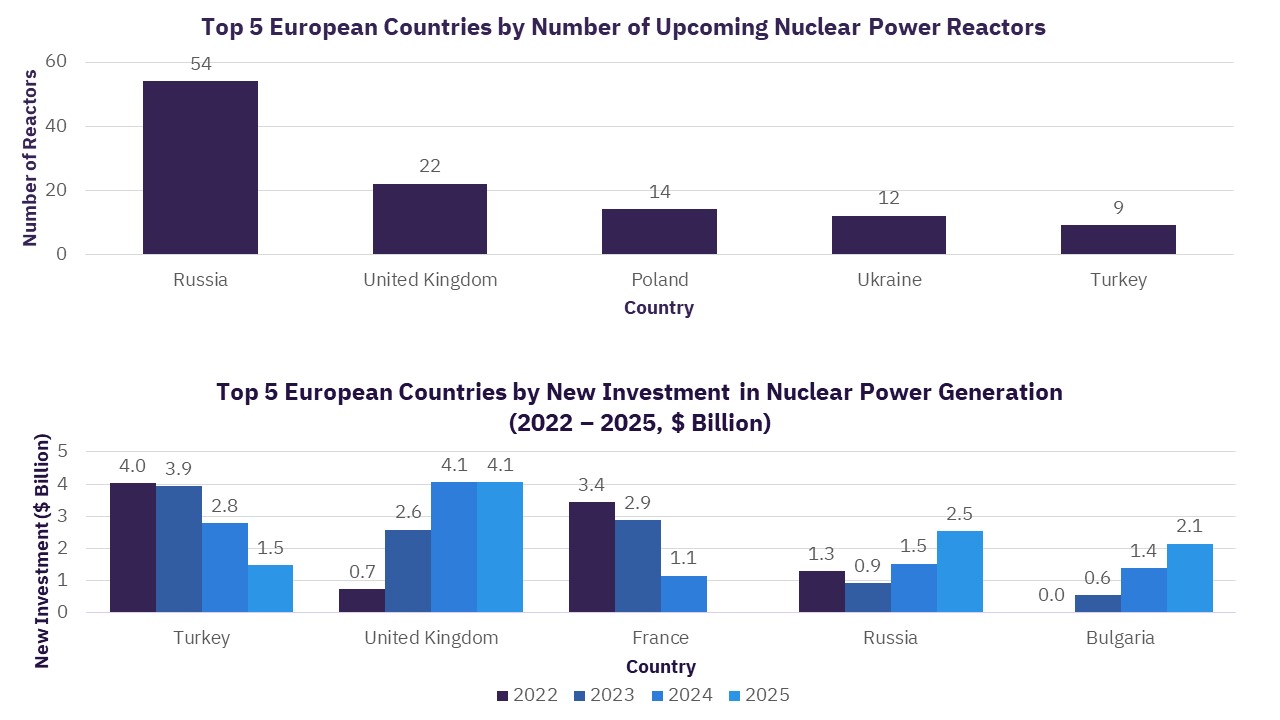

Nuclear power influences the European power landscape. According to the EC, in 2020, there are 13 countries with operational reactors, which provided 24.6% of electricity produced in Europe. According to GlobalData, Russia would add more than 50 power reactors, followed by the UK, Ukraine, Turkey, and Poland. Among the upcoming nuclear power reactors, Cape Naglonyn in Russia, Hinkley Point in England, and Ukrain-AP1000 are highly important.

Even though many European countries have a negative outlook toward nuclear power, European investments in nuclear power are expected to grow. According to GlobalData, Turkey has planned investment exceeding $12 billion in nuclear power by 2025. Western European countries such as the UK and France are not far behind. By 2025, the UK is expected to invest $11 billion in nuclear power, while France will be investing about $7 billion.

Industrial power consumption propels the demand in the European market. According to GlobalData, Russia is leading the European power consumption space. The industrial sector accounted for 58% of the country’s total power consumption in 2021. Russia is followed by Germany and France with 46% and 26%, respectively. The silver lining is that all the European countries show a slight increase in power use over a 10-year time frame of 2020-30.

EU taxonomy has the power to direct millions of dollars of investment towards sustainable businesses soon. A regulation as comprehensive as EU taxonomy is prone to be influenced by geopolitical forces and market-moving investors, but for a sustainable future, this is a critical time to take steps and achieve ambitious climate change prevention targets.

Related Data & Insights

Related Companies

China

China

France

France

United Kingdom

Ukraine

United Kingdom

United Kingdom

Germany

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer