06 Apr, 2020 US firms dominated venture capital funding landscape in artificial intelligence tech space in 2019, says GlobalData

Posted in Business FundamentalsNine of the global top ten venture capital (VC) investors (by number of investments) in the artificial intelligence (AI) space in 2019 were headquartered in the US, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Japan-based SoftBank Group was the only non-US based company to feature in the top ten list. Around 70% of the AI start-ups backed by these ten investors in 2019 are also headquartered in the US, and Chinese AI start-ups occupied the second spot with about 11% share.

“AI remains a lucrative investment opportunity and US VC firms are betting big in the space. Moreover, the launch of a US AI Initiative program by President Trump in February 2019 was also aimed at the development of AI in the country.”

These ten VC investors participated in a total of 222 funding rounds in 2019, which also remained at the same level during 2018. The proportionate investment value of these VC firms increased marginally from US$3.1bn in 2018 to US$3.3bn in 2019.

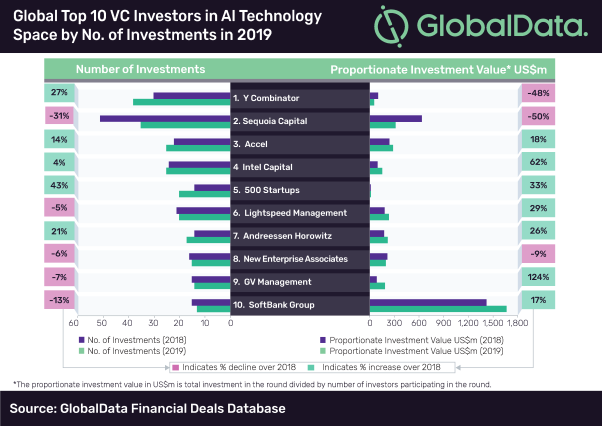

Bose continued: “Of the top ten VC investors, Y Combinator, Accel, Intel Capital, 500 Startups and Andreessen Horowitz showcased year-on-year (YoY) growth in the number of investments in 2019, while Sequoia Capital, Lightspeed Management, New Enterprise Associates, GV Management and SoftBank Group witnessed a decline.

“Y Combinator, Sequoia Capital and New Enterprise Associates also witnessed a decline in the proportionate investment value in 2019.”

Y Combinator registered the highest investment volume in 2019, while 500 Startups registered the highest growth in the number of investments in 2019, as compared to 2018. Meanwhile, SoftBank Group registered the highest proportionate investment value in 2019, while GV Management registered the highest growth in proportionate investment value in 2019 as compared to 2018.

Bose cocludes: “With rising coronavirus concerns in key markets such as the US and China, it would be noteworthy to see if the momentum in VC funding activity in AI space remains unaffected. However, AI start-ups can also emerge as saviors during this crisis. AI may find application in development of a cure or vaccine for the virus. It can also lower costs related to research on development of vaccines.

“The announcement of several VC funding deals worth more than US$100m in the AI space (such as US$462m raised by Pony.ai and US$263m raised by Berkshire Grey) during Q1 2020 is also a sign of optimism amid the coronavirus outbreak.”