M&A – Report Bundle (8 Reports)

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

M and A Deals Market Bundle Report Overview

M&A activities will play an increasingly important role in business strategies, and as valuations fall, there may be better opportunities for investors to generate healthy returns. M&A deals will be most common in sectors like power, packaging, and foodservice, among others.

As a part of this bundle, you will gain access to in-depth insights available in the following reports:

- Tech, Media and Telecom (TMT) Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Medical Devices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Power Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Packaging Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Mining Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Insurance Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Foodservices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

- Aerospace, Defense and Security Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Report 1 – Tech, Media and Telecom (TMT) Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

The digital media theme has a special place in the TMT sector and is one of the most prominent themes in each year of the M&A industry. Cloud computing’s importance has grown significantly in recent years. Cloud computing has enabled the use of shared IT infrastructure and services to create a flexible, scalable, and on-demand IT environment. It will become the dominant model for delivering and maintaining enterprise IT resources, such as software, platforms, and tools for application developers, over the next few years. Hence, M&A activity in the cloud and managed services sectors will also pick up in the coming days.

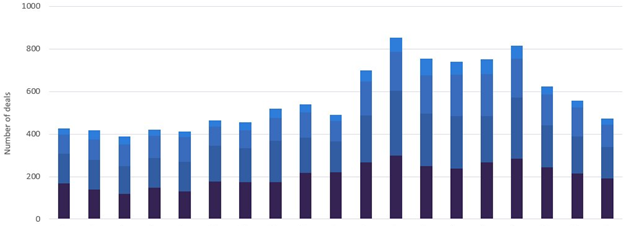

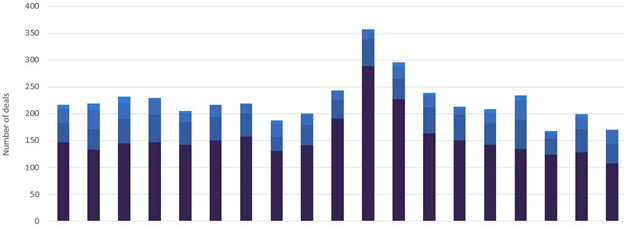

M&A Deals in TMT Sector Analysis by Segments

For more insights into the M&A deals in the TMT sector, download a free report sample

Report 2 – Medical Devices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Precision medicine is expected to reshape disease treatment with the potential to provide superior outcomes in smaller patient populations thereby increasing patient expectations around efficacy. Moreover, smart hospitals will utilize integrated technologies to provide seamless and highly efficient healthcare-tailored solutions to each patient. It will also allow for faster emergency response times through sophisticated coordination of elevators, staff, patient health records, and surgical suites to maximize emergency response effectiveness.

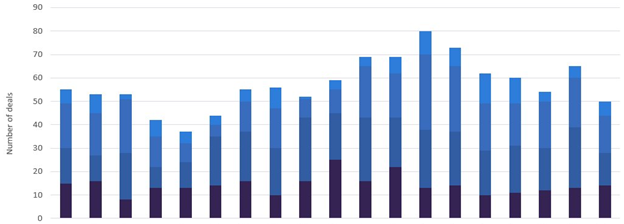

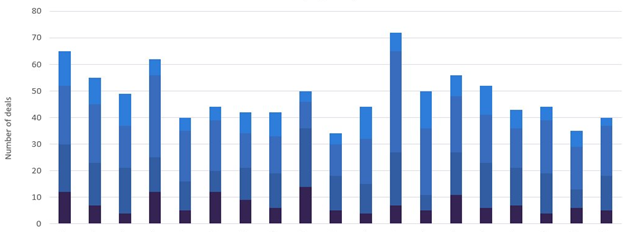

M&A Deals in the Medical Devices Sector Analysis by Segments

For more insights into the M&A deals in the medical devices sector, download a free report sample

Report 3 – Power Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

The top themes driving power M&A activity in the power industry are ESG and energy transition. Private equity firm Partners Group has acquired a majority stake in energy-as-a-service (EaaS) provider Budderfly. Likewise, for energy transition, HIF Global and renewables company Enel Green Power will invest in a wind farm project in Chile. At present, reducing carbon emissions is fundamental for the world if it must move towards net zero and tackle climate change. Carbon emissions can be reduced by implementing methods like carbon capture and storage; and through renewable energy tech such as wind farms or solar energy; geothermal energy; batteries; and much more.

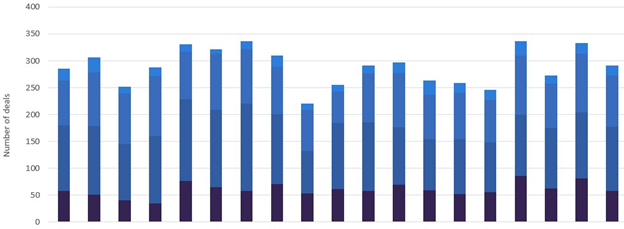

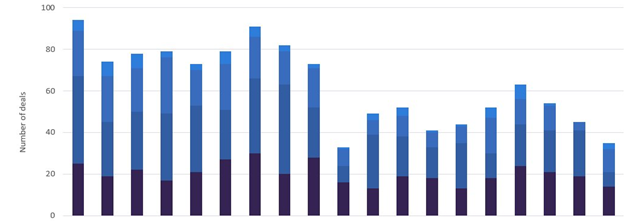

M&A Deals in the Power Sector Analysis by Segments

For more insights into the M&A deals in the power sector, download a free report sample

Report 4 – Packaging Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Circular economy and emerging economies are the top two themes that are driving M&A activity in the packaging sector. Tomypak and EB Packaging are packaging companies in Malaysia which is an emerging economy. The acquisition of the later by the former company will consolidate Tomypak’s position in the Malaysian packaging market after a fire incident at Tomypak’s manufacturing plant at Senai in late 2021 disrupted the company’s manufacturing capabilities.

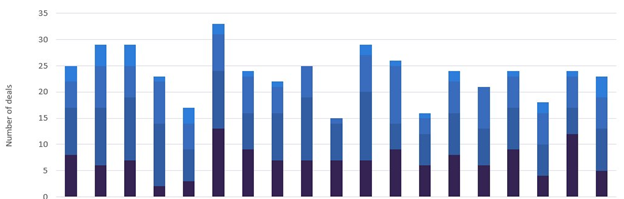

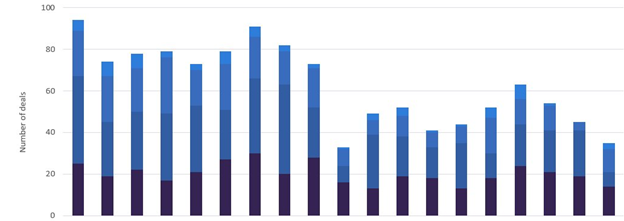

M&A Deals in the Packaging Sector Analysis by Segments

For more insights into the M&A deals in the packaging sector, download a free report sample

Report 5 – Mining Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

The top two themes driving the M&A activity in the mining industry are geopolitics and Lithium-ion batteries. The conflict between Ukraine and Russia is a recent example of a geopolitical issue that has impacted commodity prices due to disruptions in production and trade flows. Moreover, demand for lithium and other battery minerals, like cobalt, graphite, and copper, among others is projected to increase in the coming days because demand from electric vehicles will generate a three-fold increase in capacity across battery manufacturers.

M&A Deals in Mining Sector Analysis by Segments

For more insights into the M&A deals in the mining sector, download a free report sample

Report 6 – Insurance Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

The top themes driving M&A activities in the insurance sector were channel strategy and financial wellness among others. The COVID-19 pandemic hastened digitization and highlighted the importance of digital insurance distribution channels over physical branches. Themes like digitization among younger generations and the rise of insurtech start-ups are also contributing to the sector’s shift toward more digital channels.

M&A Deals in Insurance Sector Analysis by Segments

For more insights into the M&A deals in the insurance sector, download a free report sample

Report 7 – Foodservices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Ease & affordability and simplicity are the most important themes driving foodservice M&A activity. Each new climate-related disaster, human rights violation, or corruption scandal reinforces the public perception that companies must take meaningful steps to address ESG issues. Companies must constantly innovate with exciting offerings to differentiate themselves in an increasingly competitive marketplace as the value of experience grows. This opens the door to more unusual and challenging products that can meet these demands for novelty and uniqueness.

M&A Deals in Foodservice Sector Analysis by Segments

For more segment insights into the foodservice sector, download a free report sample

Report 8 – Aerospace, Defense and Security Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

The top two themes driving M&A activity in the aerospace, defense, and security (ADS) sector were space systems and supply chains. Eutelsat Communications and key OneWeb shareholders have signed a memorandum of understanding (MoU) to create a leading global player in connectivity. With respect to supply chain, Precision Aviation Group (PAG) has entered into a definitive agreement to acquire PTB Group. Space systems enable more timely and accurate intelligence and communication, which is critical to military operations. They are becoming increasingly important, and companies and countries will suffer without them. Furthermore, advanced materials have the power to change military missions’ operational capabilities by increasing both lethality and defense.

M&A Deals in ADS Sector Analysis by Deal Size

For more insights into the M&A deals in the ADS sector, download a free report sample

Key Players - Tech, Media and Telecom (TMT) Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players – Medical Devices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players – Power Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players – Packaging Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players – Mining Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players - Insurance Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players - Foodservices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Key Players - Aerospace, Defense and Security Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

Table of Contents

Frequently asked questions

-

FAQ - Tech, Media and Telecom (TMT) Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

How has the importance of cloud computing grown significantly in recent years?

In recent years, cloud computing has enabled the use of shared IT infrastructure and services to create a flexible, scalable, and on-demand IT environment.

-

FAQ – Medical Devices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

How will smart hospitals maximize emergency response effectiveness?

Smart hospitals will allow for faster emergency response times through sophisticated coordination of elevators, staff, patient health records, and surgical suites to maximize emergency response effectiveness.

-

FAQ – Power Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

What methods can be implemented to reduce carbon emissions?

Carbon emissions can be reduced by implementing methods like carbon capture and storage; and through renewable energy tech such as wind farms or solar energy; geothermal energy; batteries, and so on.

-

FAQ – Packaging Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

What key themes are driving M&A activity in the packaging sector?

Circular economy and emerging economies are the key themes that are driving M&A activity in the packaging sector.

-

FAQ – Mining Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

What key themes are driving M&A activity in the mining sector?

The top two themes driving the M&A activity in the mining sector are geopolitics and Lithium-ion batteries.

-

FAQ – Insurance Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

What are the top themes driving M&A activities in the insurance sector?

The top themes driving M&A activities in the insurance sector were channel strategy and financial wellness among others.

-

FAQ – Foodservices Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

Why should companies in the foodservice sector constantly innovate themselves?

Companies must constantly innovate with exciting offerings to differentiate themselves in an increasingly competitive marketplace as the value of experience grows.

-

FAQ – Aerospace, Defense and Security Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence

-

What key themes drove M&A activity in the ADS sector?

The key themes that drove M&A activity in the ADS sector were space systems and supply chains.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more reports