14 Apr, 2020 Huge stimulus packages following COVID-19 outbreak to widen fiscal deficit in major economies, says GlobalData

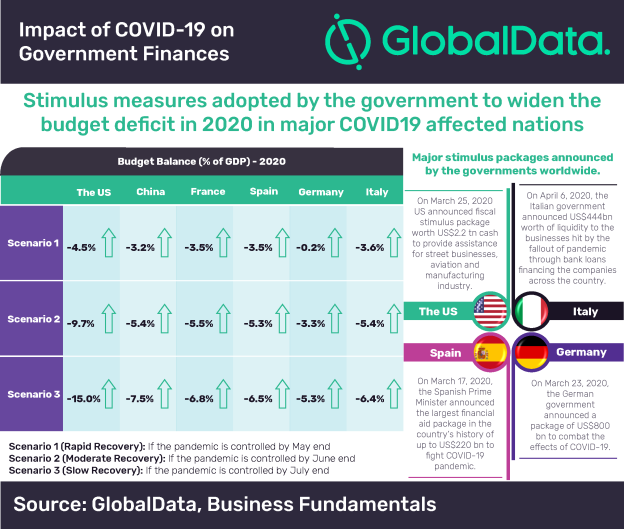

Posted in Business FundamentalsGovernment and central banks in nations that have been majorly affected by COVID-19 such as the US, China, Italy, Spain and Germany have sanctioned monetary and fiscal stimulus measures to combat the commotion caused by the substantive outbreak. The US has embarked on a massive US$2.2tn stimulus package, equivalent to 10.26% of GDP, whereas Germany, France, Spain and Italy’s stimulus accounted for 31.6%, 14.2%, 15.9% and 23.8% of GDP, respectively, says GlobalData, a leading data and analytics company.

Shruti Upadhyay, Economic Research Analyst at GlobalData, says: “Stimulus packages to revive the economy are expected to put pressure on government finances. Monetary policy is responding with more than 50 central banks across the world practicing quantitative easing policy in 2020. The fiscal response in a number of vital economies, including China, Germany, Italy and France, has primarily focused on supporting businesses through this period of uncertainty by restructuring loans, tax cuts or retraining. Fiscal responses have also supported households, through the medium of cash payments, income support or tax credits.”

Upadhyay continues: “The rapid outbreak presents an alarming health crisis, crippling major sectors such as trade, travel & tourism, aviation, hotels, transport and communication services, leading to an inflated fiscal deficit in countries such as the US, Italy, Spain, China and Germany in 2020.

“The sheer magnitude of the outbreak has led to mounting efforts by governments to avert a sharp downturn of their economies. The economies are struggling with measures to contain the outbreak and below illustrative coronavirus scenarios and their impact on fiscal deficit has been explained.

“The anticipated ‘slowing down of manufacturing activity’ is expected to affect the GDP of many countries, weighing on the multiple states’ tax resources and leading to budget deficit skyrocketing in 2020. Countries such as the UK, France, Spain and Italy have made guaranteed credit to the citizens, seeking to prevent a cascade of non-payments, adding to government expenditure in the regions. The mandatory lockdown in countries such as the US, India, Italy, France, Spain, Germany and many others with medical systems likely to be overburdened in the coming months is adding to the bloated fiscal deficit of these countries.”

The US Government is poised to take on several measures to offset the economic impact of the virus, along with tax cut incentives and healthcare spending backed by various stimulus measures announced by the government will lead to wider fiscal deficit in 2020 and 2021. The ongoing spread of the pandemic is expected to disrupt the German supply chains due to government-mandated plant closures and lockdown in the country, which are expected to put an added pressure on the country’s fiscal deficit. France, with an aging population and billions invested in stimulus expenditure and support measures for companies affected by COVID-19, could see its fiscal budget reach 3.5% in 2020, according to GlobalData estimates.

Upadhyay concludes: The coronavirus catastrophe has caused a major spike in unemployment levels with millions of workers being jobless and business closures leading to reduced tax revenues for the government. GlobalData expects the adverse fiscal dynamics to increase the fiscal deficit to an all-time high since 2008 financial crisis, which introduces noteworthy downside risk to the medium-term fiscal outlook.”