03 Apr, 2020 Home Depot’s digital-physical integration strategy stacking up on sentimental growth, says GlobalData

Posted in Business FundamentalsOn the back of comparable sales growth* driven by its strategy to unify digital and physical shopping, Home Depot witnessed double digit sentiment growth in the fourth quarter (Q4) of 2019, says GlobalData, a leading data and analytics company.

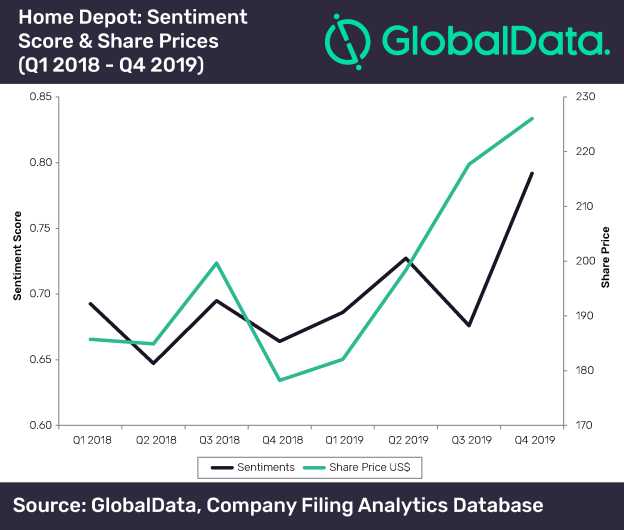

GlobalData’s Company Filing Analytics platform found that Home Depot’s overall sentiment score grew 16% in Q4 2019 (ending February 3, 2020) compared to Q3 2019 (ending November 3, 2019).

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Home Depot reported its best year-on-year (y-o-y) comparable sales growth in Q4 2019. Digital investments are paying-off with online sales growing 20% (y-o-y) in Q4 2019, adding to the sentimental growth.

“A strong holiday season coupled with event days such as Black Friday and Cyber Monday also generated record sales for the company across physical as well as digital channels.”

The company is currently focused on fueling more digital investments in 2020 when compared to brick and mortar stores, which it plans to ramp up in 2021. Home Depot expects perfect digital-physical integration by the end of 2022.

Bose, continues: “Closing the divide between physical and digital shopping has been a lucrative area for several retailers. In this regard, Home Depot’s transformational gains in the space have been significant.”

In the Q4 2019 earnings transcript, ‘Supply Chain’, ‘Customer’, ‘Experience’ and ‘Digital’ were the top mentions. Home Depot is highly optimistic about its core ‘One Home Depot’ strategy to bridge the gap between digital and physical shopping. The strategy enhanced the delivery process and drove customer satisfaction resulting in comparable sales growth.

Bose adds: “During the quarter, Home Depot saw large downloads of its mobile app and double-digit growth rates in usage of app tools such as product locator and image search.

“Rising digital investments caused margin declines in Q4 2019, with net income on a downtrend since Q2 2019. Although, the One Home Depot investment program helped the company in generating sales of over US$9bn during the year (fiscal year ending on February 3, 2020), against a committed investment of US$11bn (cumulative across years, starting 2017) for driving the core strategy.”

Investor sentiments were also positive across the quarters in 2019, with share prices being on a steady uptrend. On similar lines, the average share prices for February 2020 were up 5% when compared to January 2020.

Bose adds: “However, the company’s share prices have been in free fall post the earnings call (on February 25, 2020s), due to a dent in investor sentiments following growing coronavirus concerns and long-term debt issues.”

Though, Home Depot did not emphasize on the virus’ impact on business in the Q4 2019 earnings transcript, it issued a statement on March 18, 2020 notifying adjustment in store hours in response to COVID-19.

Bose concludes: “Short-term margins are expected to be under pressure with a spike in Home Depot’s 2020 digital investments. With the company procuring a fair share of goods from China, its procurement strategy tweaks are yet to be seen, as supply chains are being tested by the coronavirus outbreak.”

*Retail sales generated in quarter ending February 3, 2020 compared to the same period in 2019