11 May, 2020 Goldman Sachs is top M&A financial adviser in UK for coronavirus-hit Q1 2020

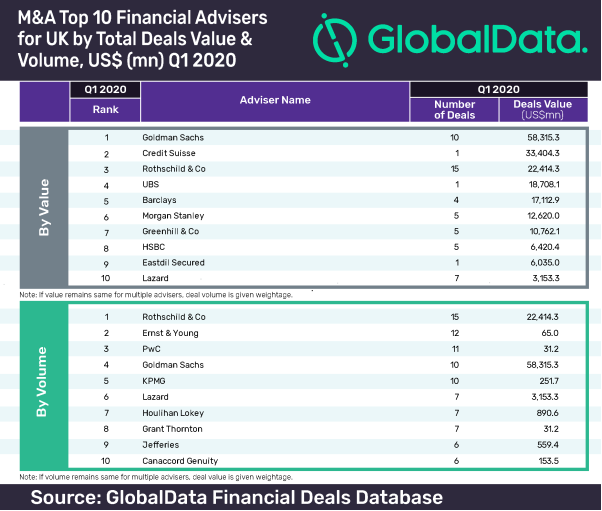

Posted in Business FundamentalsGoldman Sachs is the top M&A financial adviser based on deal value in Q1 2020, according to GlobalData, a leading data and analytics company. The US firm advised on ten deals worth US$58.3bn in Q1 2020.

GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world, confirmed that Credit Suisse occupied the second position with total deal value worth US$33.4bn.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, comments: “Advising on big-ticket deals such as the US$33.4bn Aon – Willis Towers Watson merger helped Goldman Sachs occupy the top spot. The firm managed to advise on six deals worth more than or equal to US$1bn.”

Goldman Sachs, which topped the league table of M&A financial advisers in the UK, also stood at the first position in GlobalData’s recently released global league table of top 20 M&A financial advisers.

Rothschild & Co is the top M&A financial adviser based on deal volume in Q1 2020 having advised on 15 deals worth US$22.4bn. Ernst & Young occupied the second position with 12 transactions worth US$65m.

Aurojyoti Bose comments: “Rothschild & Co topped by deal volume and was also third in terms of value. In contrast, the majority of the top ten firms by volume did not find a place in the top ten firms by value. Only three of the top ten be volume (Rothschild & Co, Goldman Sachs and Lazard) featured in the list of top ten advisors by value.”