16 Apr, 2020 COVID-19 slowed TMT M&A by 26% Q1 2020, with worse to come

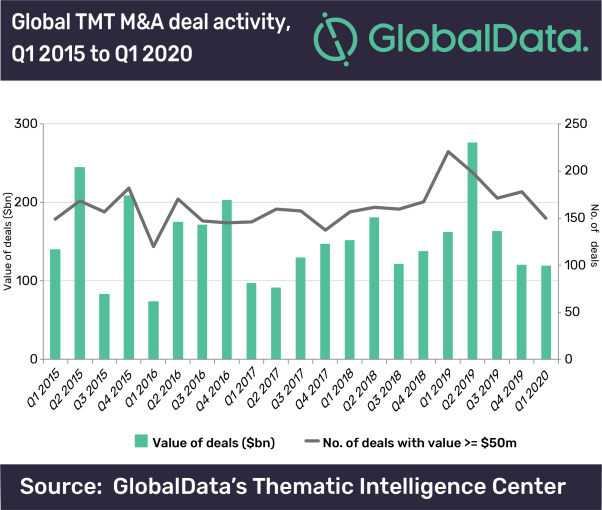

Posted in Business FundamentalsDeal activity in the first quarter of 2020 was 26% down on Q1 2019. COVID-19 lock-downs in Q2 2020 will cause the M&A market to contract further, says GlobalData, a leading data and analytics company.

GlobalData’s recent report, M&A in TMT – 2019 round-up, shows that, in 2019, mergers and acquisitions (M&A) activity grew 20% to $737bn, and Q2 2019 was the best quarter, in terms of deal value in the last five years.

Sapana Meheria, Thematic Analyst at GlobalData, comments: “We saw many mega deals, including United Technologies acquiring Raytheon for $88bn, Global Payments acquiring TSYS for $21.5bn, and Salesforce acquiring Tableau for $16bn. However, deal values and volumes have since plummeted.”

Meheria concludes: “The COVID-19 downturn may boost M&A activity once economies start to recover. In Q1, 2020, share prices for many TMT companies have fallen by over a third – some of which may become attractive acquisition targets. Many start-ups are already running out of funding, so by mid-year will be highly vulnerable to potential acquirers. While these factors will push M&A activity, don’t expect mega deals to happen at 2019’s level.”